If you’re responsible for your company’s bottom line, you know that every investment must be justified—not just at purchase, but over the full lifecycle. For every business considering implementing new phone systems, “total cost of ownership VoIP” is far more than a slogan; it is the foundation of educated decision-making. To truly understand how your communications infrastructure affects cash flow, profitability, and future growth, you must look beyond sticker prices.

In this article, you will learn how to calculate ROI and break-even points, estimate depreciation, evaluate hidden costs, and build a solid TCO framework. Regardless of the size of your business, these insights are able to help you in making sound decisions that reduce risk and boost revenue.

Section 1: Defining Total Cost of Ownership for VoIP and Legacy Phone Systems

The total cost of ownership (TCO) of a company phone system is the total of all direct and indirect costs related to the system’s acquisition, configuration, operation, and eventual retirement.For VoIP systems, TCO extends well beyond monthly service fees. It encompasses:

- Initial Capital Expenditure: Hardware, software, licensing, and instation

- Ongoing Operational Costs: Monthly service, maintenance, support, and upgrades

- Indirect Costs: Training, downtime, productivity impact, and opportunity costs

- End-of-Life Expenses: Decommissioning, data migration, and disposal

When comparing VoIP to traditional PBX systems, the TCO framework allows you to make apples-to-apples comparisons that account for every dollar spent over the system’s useful life.

Section 2: The TCO Framework—Building Blocks for Accurate Analysis

A rigorous TCO framework for business phone cost analysis should include:

Acquisition Costs:

- Hardware (phones, routers, swithes, servers)

- Software licenses, VoIP endpoints, SIP trunks

- Professional installation and configuration

Recurring Costs:

- Subscription or service fees

- Maintenance contracts and technical support

- Bandwidth upgrades and network management

Hidden and Variable Costs:

- Employee training and onboarding

- Downtime during migration or outages

- Security and compliance (e.g., HIPAA, GDPR)

- Integration with CRM, ERP, and other business platforms

Depreciation and Lifecycle Management:

- Asset depreciation schedules (3-year vs. 5-year)

- Upgrade cycles and technology obsolescence

End-of-Life Costs:

- Decommissioning legacy systems

- Data backup, migration, and compliance archiving

By mapping these elements, you can perform a granular phone system ROI analysis and avoid budgetary surprises down the road.

Section 3: Hidden Costs—What Most Businesses Overlook

Many companies underestimate the hidden costs of telecom transitions.

While VoIP systems can reduce per-user costs, the total cost of ownership can increase if implementation is poorly planned or overlooked expenses pile up.

Training & Change Management

- Employees need training on new tools, call handling features, softphones, and workflows.

- IT teams must be trained for configuration, troubleshooting, and admin tasks.

Downtime and Business Continuity

- Cutover failures can interrupt service, affecting customer support and sales functions.

- Legacy systems may need to run in parallel during migration.

Security, Compliance, and Risk

- VoIP systems introduce risks like SIP attacks, fraud, phishing, and call recording compliance.

- Organizations handling sensitive data must ensure encryption, logging, and retention policies.

Integration and Customization

- New systems must integrate with CRM, helpdesk systems, and VoIP recording tools.

- Integration projects can include developer time, API work, and vendor coordination.

Opportunity Costs

- Employee time spent on transition can reduce productivity and slow daily operations.

Section 4: Depreciation Schedules—Aligning Accounting with Reality

A critical component of TCO is how companies allocate capital cost over time.

Legacy PBX systems are typically depreciated over 5–10 years, while VoIP hardware may follow shorter depreciation schedules.

3-Year Depreciation

- Best for: Fast-growth companies, tech-forward organizations, firms anticipating rapid change

- Pros: Faster write-off, aligns with frequent tech refresh cycles

- Cons: Higher annual depreciation expenses; may not match actual hardware lifespan

5-Year Depreciation

- Best for: Stable, risk-averse companies, or those with longer procurement cycles

- Pros:Lower annual depreciation, smoother impact on financial statements

- Cons:May underestimate the pace of obsolescence, leading to surprise capital outlays

Practical Example

Suppose you invest $30,000 in VoIP hardware.

- On a 3-year schedule, that’s $10,000/year in depreciation.

- On a 5-year schedule, it’s $6,000/year.

Align your depreciation model with your business’s risk tolerance, upgrade philosophy, and capital budgeting strategy.

Section 5: Break-Even Calculations—When Does VoIP Pay Off?

Calculating the break-even point is essential for strategic investment guidance. Here’s a step-by-step approach:

- Total Upfront Costs: Hardware, installation, training, and migration

- Estimate Monthly Recurring Costs: Service fees, maintenance, bandwidth

- Project Savings vs. Legacy System: Reduced long-distance charges, lower maintenance, improved productivity

- Calculate Break-Even Point:

Break-Even Months=Upfront Costs Monthly Savings Break-Even Months=Monthly Savings Upfront Costs|

Example Calculation

- Upfront VoIP Investment: $20,000

- Monthly Savings vs. PBX: $1,200

Break-Even Months=20,0001,200≈16.7Break-Even Months=1,20020,000≈16.7

In this scenario, you’d recoup your investment in just under 17 months. After that, every month delivers pure ROI.

Section 6: 3-Year and 5-Year TCO Projections—Modeling for Different Business Sizes

TCO projections should be tailored to your business size and growth trajectory. Here’s how to approach it:

Small Business (10-50 Employees)

- Lower upfront costs: Leverage cloud-based VoIP, minimal hardware

- Rapid ROI: Break-even often within 12-18 months

- Key risks: Underestimating growth, scaling costs

Midsize Business (51-250 Employees)

- Hybrid models: Mix of cloud and on-premise

- Integration focus: CRM, collaboration tools

- TCO drivers: Training, network upgrades, support contracts

Enterprise (250+ Employees, Multi-site)

- Complex deployments: High integration, custom features, regulatory compliance

- Longer break-even: 18-30 months typical

- TCO risks: Vendor lock-in, costly integrations, hidden compliance costs

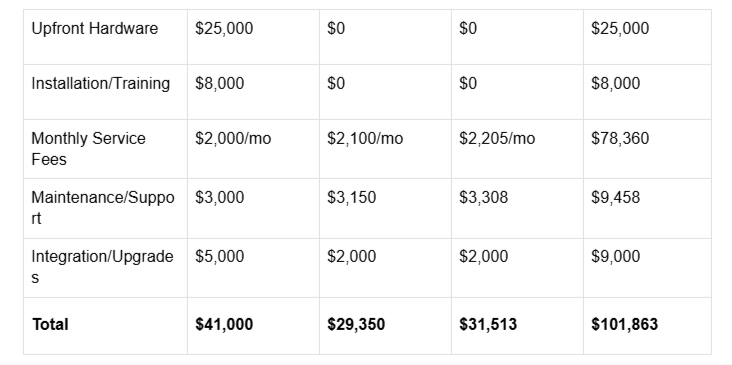

Example 3-Year TCO Model (Midsize Business, 100 Users)

Section 7: Financial Modeling—Scenario Analysis for Smarter Decisions

Advanced financial modeling empowers you to pressure-test assumptions and plan for best- and worst-case scenarios. Here’s how to approach it:

Step 1: Identify Key Variables

- User growth rate

- Usage patterns (calls, video, mobile)

- Vendor pricing changes

- Technology refresh cycles

Step 2: Build Flexible Models

Use spreadsheets or financial modeling tools to create dynamic TCO calculators. Change variables to observe the immediate effects on ROI and break-even.

Step 3: Sensitivity Analysis

Run “what-if” scenarios:

- What if user count doubles in 18 months?

- What if bandwidth costs drop by 30%?

- What if regulatory requirements force a compliance upgrade?

Step 4: Strategic Recommendations

Leverage your models to make CFO-level recommendations:

- Should you invest in extra capacity now, or scale on demand?

- Is it better to lease hardware or buy outright?

- What’s the risk-adjusted ROI of each option?

Section 7: Financial Modeling—Scenario Analysis for Smarter Decisions

Advanced financial modeling empowers you to pressure-test assumptions and plan for best- and worst-case scenarios. Here’s how to approach it:

Step 1: Identify Key Variables

- User growth rate

- Usage patterns (calls, video, mobile)

- Vendor pricing changes

- Technology refresh cycles

Step 2: Build Flexible Models

Use spreadsheets or financial modeling tools to create dynamic TCO calculators. Change variables to observe the immediate effects on ROI and break-even.

Step 3: Sensitivity Analysis

Run “what-if” scenarios:

- What if user count doubles in 18 months?

- What if bandwidth costs drop by 30%?

- What if regulatory requirements force a compliance upgrade?

Step 4: Strategic Recommendations

Leverage your models to make CFO-level recommendations:

- Should you invest in extra capacity now, or scale on demand?

- Is it better to lease hardware or buy outright?

- What’s the risk-adjusted ROI of each option?

Section 8: Making the Case—Presenting TCO and ROI to stakeholders

For most organizations, the final hurdle is securing buy-in from leadership. Here’s how to frame your findings:

- Lead with Example Value: Show how the investment aligns with business goals—growth, agility, customer experience.

- Quantify Financial Impact: Use clear CFO-ready charts and tables to illustrate break-even, ROI, and long-term savings.

- Highlight Risk Reduction: Emphasize how a lower TCO reduces exposure to tech obsolescence, compliance risk, and vendor lock-in.

- Address Objections: Be ready to discuss hidden costs, migration risks, and integration challenges.

TCO Mastery = Strategic Advantage

In today’s environment, mastering the total cost of ownership (TCO) analysis isn’t just a finance exercise—it’s a strategic imperative. You may position your company for long-term growth and competitive advantage by implementing a strict TCO framework, identifying hidden expenses,and utilizing quantitative financial modeling.

Whether you use a CFO, IT leader, or business owner, your ability to translate business phone cost analysis into actionable strategy will set you apart. Make every dollar count—build your case, run the numbers, and invest in communication that drives real ROI.

Looking for a tool that simplifies or quantifies phone system costs? Reach out for a consultation and unlock the financial clarity you deserve.